I Was Born This Way

A man named John Hawkins begins this story. John was an English sailor, merchant, trader, and naval “consultant” who was so instrumental for the British that they received a knighthood. He also had a legacy of being the first British trader to profit from the triangle slave trade, which was not his best idea.

It’s easy to attach a last name to a famous person from the past and claim direct lineage. In this case, John Hawkins probably also left behind a gene pool full of entrepreneurship, adventure, and business on an island whose population counts in the thousands. What followed for the Hawkins was a long history of plantation ownership on the Island of Barbados. Generations later, an unjust society eventually learned to live together, and a post-independence melting pot produced the grandparents, parents, and seedlings that eventually became David Terrence Durant.

“Things may come to those who wait, but only the things left by those who hustle.” Abraham Lincoln

Young Investor

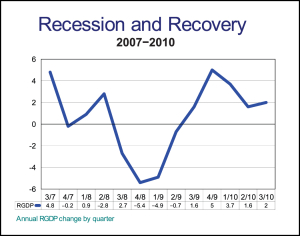

The world was emerging out of the worst financial crisis since the Great Depression. Unemployment skyrocketed to all-time highs, global financial institutions went under, and the stock market crash in 2008 led economists to title this period “The Great Recession.” During the week of October 6, 2008, stock markets worldwide fell by over 15%. Internationally, Indonesia halted trading after dropping 10% in a day, Iceland closed its markets for three days after plunging 77%, and there was widespread panic in England after substantial drops in the London Stock Exchange. The head of the International Monetary Fund (IMF) warned that the world financial system was teetering on the “brink of systemic meltdown.” Business Week called it the “Panic of 2008.” While many investors approached the market cautiously, one investor decided that the timing was perfect. During the panic, he decided to invest his entire net worth in the stock market.

David began investing at 13 when he used his savings to purchase shares in two companies. His first investment grew 50%, but his second one – in American Online (AOL) – grew 5,000% before he sold it. His successes allowed him to pursue a finance degree at the University of Florida, where he earned an academic scholarship and graduated cum laude in 2003. Not all of David’s investments had happy endings. Like many investors, David was part of the dot com bust, which taught him a valuable lesson: real investment analysis requires more than luck. Everyone knew the saying, “Buy low, sell high,” but no one knew the ultimate question of when to buy and when to sell. It took David 10 years to find those answers.

David began investing at 13 when he used his savings to purchase shares in two companies. His first investment grew 50%, but his second one – in American Online (AOL) – grew 5,000% before he sold it. His successes allowed him to pursue a finance degree at the University of Florida, where he earned an academic scholarship and graduated cum laude in 2003. Not all of David’s investments had happy endings. Like many investors, David was part of the dot com bust, which taught him a valuable lesson: real investment analysis requires more than luck. Everyone knew the saying, “Buy low, sell high,” but no one knew the ultimate question of when to buy and when to sell. It took David 10 years to find those answers.

Wall Street

After college, David worked on Wall Street as a valuation analyst for mergers and acquisitions. As his experience grew, he started developing unique valuation formulas and methodologies that proved insightful for investing in the stock market. Initially, he dismissed his findings, but after several years, all of his research proved right, so he started using those techniques to invest his own money in the stock market. As a result, David had great investing success. His analysis foresaw the Great Recession, so David decided to cash out of the stock market and use his profits to travel worldwide for a year.

During his travels, David had the opportunity to read The Intelligent Investor by Benjamin Graham. This book was hailed in the financial world as the “Bible of Investing.” It preaches a fundamental value investing approach that Warren Buffett used to become one of the world’s greatest investors. “When I read the book, I was immediately able to piece together how the entire market functioned and how to pick the best investments,” said David.

During his travels, David had the opportunity to read The Intelligent Investor by Benjamin Graham. This book was hailed in the financial world as the “Bible of Investing.” It preaches a fundamental value investing approach that Warren Buffett used to become one of the world’s greatest investors. “When I read the book, I was immediately able to piece together how the entire market functioned and how to pick the best investments,” said David.

While staring out the oversized window of a truck going down a dusty road on safari in Africa, he discovered how to implement Graham’s teachings fully. What it required was David’s valuation techniques and some modern-day technology. Then, David crafted a 20-page investing thesis that he scribbled in the margins of his travel journal.

Great Recession

David returned to the US during the financial crisis. Lehman Brothers had gone under, the stock market was plummeting, and his ill-timed sabbatical meant no jobs existed. David found himself at a crossroads with only 3,000 dollars in the bank. He needed to make money any way he could to survive the recession. He was left with the stock market with little chance of employment, which was in significant disarray. He started researching thousands of companies, whereas the normal analyst on Wall Street was responsible for 10 to 20. David had never implemented his theories and ideas on such a large scale, but his early experience paid off. He found numerous undervalued companies but didn’t have money to invest. That’s when he hatched a plan.

David returned to the US during the financial crisis. Lehman Brothers had gone under, the stock market was plummeting, and his ill-timed sabbatical meant no jobs existed. David found himself at a crossroads with only 3,000 dollars in the bank. He needed to make money any way he could to survive the recession. He was left with the stock market with little chance of employment, which was in significant disarray. He started researching thousands of companies, whereas the normal analyst on Wall Street was responsible for 10 to 20. David had never implemented his theories and ideas on such a large scale, but his early experience paid off. He found numerous undervalued companies but didn’t have money to invest. That’s when he hatched a plan.

David returned to the University of Florida to consult with his old Finance professor, Dr. Andy Naranjo. Naranjo found his valuation theories fascinating, and he said, “The only way to prove that your theories work is to do something bold and undeniable.”

Finally, An Entrepreneur

Following that meeting, David made one of the toughest decisions of his life. He decided to liquidate his 401k and max out all his credit cards. He poured the money into the stock market. Then, he used margin (brokerage debt) to gain even more leverage. David made a huge bet that his research was correct. A single mistake would have resulted in bankruptcy. His risk-averse mother didn’t speak to him for three days after he confessed to what he had done. This all-in bet was the boldest thing he had ever done, but to David, the risk is not defined by volatility; instead, the risk is the threat of buying overvalued investments. As such, his gamble was always a smart – but nervous wrecking – move. Success would have been undeniable.

David used his valuation analysis to pick the very best investments. Two years later, those original investments resulted in stock market gains of over 1,200%. His investing methodology is now part of a company he created called WikiWealth.com. WikiWealth has the largest breadth of comprehensive investment research in the world. David “founded WikiWealth to mobilize the diverse talents of Main Street investors to produce the highest quality investment research. Now everyone can meet their investment goals as he did.” David believes that investors deserve the highest quality research. He spent two years creating that research, which was the beginning of his entrepreneurial future. Note: David eventually sold WikiWealth in 2016.

David used his valuation analysis to pick the very best investments. Two years later, those original investments resulted in stock market gains of over 1,200%. His investing methodology is now part of a company he created called WikiWealth.com. WikiWealth has the largest breadth of comprehensive investment research in the world. David “founded WikiWealth to mobilize the diverse talents of Main Street investors to produce the highest quality investment research. Now everyone can meet their investment goals as he did.” David believes that investors deserve the highest quality research. He spent two years creating that research, which was the beginning of his entrepreneurial future. Note: David eventually sold WikiWealth in 2016.

“Whenever you find yourself on the side of the majority, you need to pause and reflect.” Mark Twain

Full-Time Entrepreneur

Although David’s ambition led him to invest, he only pursued that avenue because it was the most lucrative of the options at his disposal. David began his business career selling chocolate candy bars for troupe 490 of the local Cub Scouts. To raise money for the scouts, David knocked on every door on the military base he lived. He raised roughly $227 versus the second- and third-place finishers of $78 and $15, respectively. David’s entrepreneurial adventure had begun. He later took up the entrepreneurial trifecta of mowing lawns during the summer, shoveling snow during the winter, and selling lollipops between school classes.

Just as the internet transformed the world, a 12-year-old David made a website as another revenue-making venture. The site catered to the one thing he knew: video games. At this early stage of the internet, there were only three businesses that would pay money to advertise on a website: porn, CD now, and warez (illegal downloads). Suffice it to say that David made zero money. Next, he focused on investing in internet stocks, where fortunes were made.

Fast forward to the Great Recession. David had the energy and training to pursue his goal of finally combining entrepreneurship with investing. WikiWealth was born to help Main Street investors beat the stock market using the power of collaboration. Along the path to developing WikiWealth, David trained in the dark arts of digital marketing, an exceedingly useful skill for his subsequent ventures. After two years of building WikiWealth, David finally decided to head back to school. He attended Emory University’s Goizueta Business School to determine why he wasn’t a billionaire like every other tech founder #NoPressure.

Fast forward to the Great Recession. David had the energy and training to pursue his goal of finally combining entrepreneurship with investing. WikiWealth was born to help Main Street investors beat the stock market using the power of collaboration. Along the path to developing WikiWealth, David trained in the dark arts of digital marketing, an exceedingly useful skill for his subsequent ventures. After two years of building WikiWealth, David finally decided to head back to school. He attended Emory University’s Goizueta Business School to determine why he wasn’t a billionaire like every other tech founder #NoPressure.

During orientation weekend, a professor named Charlie Goetz completely captivated David’s attention. Charlie started nine businesses without VC capital and was successful at each. Get the Great Entrepreneurial Divide to see what he’s all about. Retired but not done with building things, he put his time and attention into helping MBA students find the same success he enjoyed. David summarily took both of Charlie’s classes during the first semester they were offered.

While at school, David worked with an entrepreneur to build a Charleston, SC, photography business. The business was already established but was bleeding money and would eventually go bankrupt at the current burn rate. David transformed the business through new websites, pricing schemes, sales techniques, and digital marketing. Profits tripled after only 18 months and doubled again after that. Finally, David had the skills and experience to transform anything from successful startups to existing companies.

While at school, David worked with an entrepreneur to build a Charleston, SC, photography business. The business was already established but was bleeding money and would eventually go bankrupt at the current burn rate. David transformed the business through new websites, pricing schemes, sales techniques, and digital marketing. Profits tripled after only 18 months and doubled again after that. Finally, David had the skills and experience to transform anything from successful startups to existing companies.

After business school, David’s reputation as an entrepreneur generated interest in his starting and transforming businesses for others. He was interested in real estate companies, fitness apps, and consumer products, but most didn’t pass his early viability tests. See David T. Durant’s Business Strategy. He eventually focused on a WikiWealth app, allowing David to apply his business school lessons, interests in software development, and WikiWealth quantitative engine toward a manageable new enterprise. He also experimented with building the venture by harnessing far more third-party experts than before. The WikiWealth app was successful, but the learning opportunity provided the most value, as with most new ventures. Much like the WikiWealth.com experience, building a new venture in an unfamiliar space would provide David with more insights to help larger clients with their business needs.

After business school, David’s reputation as an entrepreneur generated interest in his starting and transforming businesses for others. He was interested in real estate companies, fitness apps, and consumer products, but most didn’t pass his early viability tests. See David T. Durant’s Business Strategy. He eventually focused on a WikiWealth app, allowing David to apply his business school lessons, interests in software development, and WikiWealth quantitative engine toward a manageable new enterprise. He also experimented with building the venture by harnessing far more third-party experts than before. The WikiWealth app was successful, but the learning opportunity provided the most value, as with most new ventures. Much like the WikiWealth.com experience, building a new venture in an unfamiliar space would provide David with more insights to help larger clients with their business needs.

“Anyone who lives within their means suffers from a lack of imagination.” Oscar Wilde

After leaving business school, David embarked on the world of management consulting. He picked Capgemini Consulting because it offered him a great experience with a fantastic company. Being a Management Consultant was a perfect synergy of his investing and entrepreneurial experiences because he could experiment with ventures on the weekend but apply proven techniques to clients during the week. If a client asked, “Have you ever launched an app?” Then he could honestly respond: “Yes, I know every part of the process.” David’s resume, skills, experience, and confidence could increase twice or thrice.

While a management consultant, David got exposure to some of the largest companies in the world… literally, two of them were worth over $100 billion. He discovered that large companies have the same problems as small companies; the only differences were speed and resources. Big companies have many people, data, and financial resources to make smart decisions. However, they still have two major impediments: a fear of failure and slow decision-making processes. David’s solution was experimenting on his own (entrepreneurship) before promoting solutions to clients (management consulting). His travels took him from Capgemini Consulting to PWC and now to Liberty Advisor Group, where David is a Principal in charge of helping clients at the intersection of business and technology.

While a management consultant, David got exposure to some of the largest companies in the world… literally, two of them were worth over $100 billion. He discovered that large companies have the same problems as small companies; the only differences were speed and resources. Big companies have many people, data, and financial resources to make smart decisions. However, they still have two major impediments: a fear of failure and slow decision-making processes. David’s solution was experimenting on his own (entrepreneurship) before promoting solutions to clients (management consulting). His travels took him from Capgemini Consulting to PWC and now to Liberty Advisor Group, where David is a Principal in charge of helping clients at the intersection of business and technology.