I love finding areas where my skills can upend an antiquated process, like selling a house. In this so called “biggest investment of our lives”, I wanted to make sure I got the best possible result. My goal? Quick sale near my asking price. Here’s how I accomplished a sale 10 times faster than my closest comparable:

Case Study Background

My house was a unique property in Charleston, South Carolina that I wanted to sell as quickly as possible. It was zoned commercial in the bottom floor and residential on the 2nd and 3rd floors. It was nearly impossible to get bank financing and the higher rates / shorter terms mirrored commercial mortgages. The last house sold in the area was on the market for 2 years. Listing my house in winter was historically the worst possible time to sell a house, because of the winter season and the unwilligness of parents taking their kids out of school half-way through the year. Unfortunately, an election year is the worst possible year to sell a home, because uncertainty causes people to stop spending and start speculating. Typically (non-cash) sales of homes could last months; whereas I needed it to close ASAP to avoid the buyers getting cold feet. Evenmore, interest rates were rising for the first time in half a decade! This. Was. The. Worst. Time. To. Sell. A. House [Full Stop]

- Challenge: If the house didn’t sell in the next month, I speculated, given my desired asking price, that it wouldn’t sell for years. My student loans, a potential job loss from an overdue recession, and my parent’s pending retirement (they were investors) made a quick sale TOP priority.

- Tools and Skills: I’m currently a Management Consultant with a background in finance and entrepreneurship. Relevant skills included: strategy, finance, digital marketing, and website development. See my website for more information: David T. Durant Website.

- Ambitious Goal: Sell the house in ONE month.

Action Plan:

- Hire Broker: I hired the best real estate broker in Charleston: Carter Rowsen. He did the traditional broker stuff like list the property, take pictures, coordinate appointments, etc. He set the sale price above the last accepted sale price, which was optimistic given my quick sale goal.

- Build Website: After receiving Carter’s professional pictures, I put together a website using a wordpress (https://wordpress.com/) template from Themeforst (http://themeforest.net/). I just picked the most popular platform and template, because it offered the best online help and stability. Weird bugs and difficult navigation slow down development far more than writing copy or tweaking graphics. The whole point of the site was to offer a non-traditional, yet sophisticated, look at my property that catered to my target audience. A typical brokerage page puts an emphasis on looking through lots of properties. I wanted my audience to fall in love with just my property. I needed the ability to talk about the property in a way that catered to my target audience, which were hard-core real estate investors who appreciated the earning potential of this unique property. I explained the ownership benefits in a financial way that further catered to my target audience. I kept a single-paged and mobile friendly site, because mobile is the #1 way of consuming content. The call to action was a button to the broker page to schedule an appointment. Here’s what I eventually created: http://www.716shelmore.com/.

- Run Google Adwords: Different advertising platforms have different limitations. I used Google adwords, because it allowed me to target specific keywords in special geographies. I wanted to be the #1 advertisement for any keyword targeting my specific neighborhood. I was more cost-conscious about the other keywords like, townhomes for sale, etc. I limited the geography to the Charleston area, because a keyword like “townhomes for sale” would be very expensive and would completely miss my target audience without a geo-limiting filter (e.g. townhomes for sale around the world (no filter) vs. townhomes for sale in Charleston (with filter). I never do this, but since time was of the essence, I allowed Google to automatically-set my cost per click rates. Typically, I would set those rates myself and save money, but I didn’t have the time to do that research. Total cost of this method: $131.31. This investment generated 91 website visits.

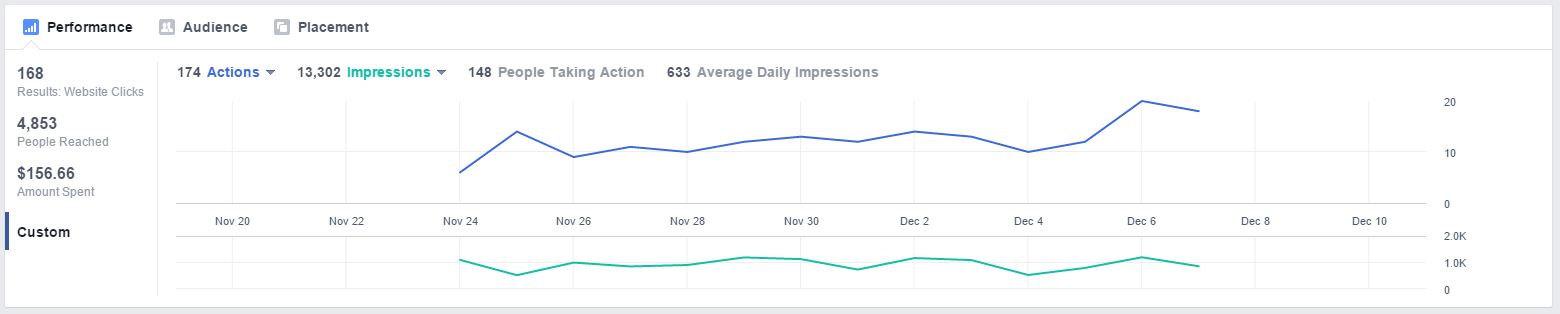

- Run Facebook Advertising: Facebook gave me very different ways to target my market. They allowed me to focus on demographics versus keywords, like with Google. Using demographics, I targeted “investors” by age, location, income level and interests (tracked by likes). I was broad with my results, because I didn’t want to assume that only investors wanted the property. Possibly a stay-at-home entrepreneur was my best target. Total cost: $156.56. For that investment, I got 168 people to the website in my chosen demographics.

- Google Analytics: Marketing isn’t useful unless you have a way to measure results. I always liked Google analytics, because it’s free and powerful. There wasn’t enough time to learn and install another analytics program. With the aid of google analytics, I tweaked my advertising and prepared for a long marketing campaign.

Results – Exceeded Expectation!

In two weeks, I generated so many appointments that my broker (Carter) commented that he was even surprised by the turn out given those huge challenges. Naturally, there was a bidding war and I got my asking price. The two bidders illustrate the difference marketing results. One offer was from a traditional route (broker website) and they bid very low in order to pick up a steal. The other offer came from my Facebook advertising campaign that targeted investors / those who liked hot real estate. The winner was the investor who liked the idea of living in the residential unit and renting out the commercial unit, which effectively canceled out their mortgage. The final sale price was 10k higher than my best guess and a full 30k higher than my worse acceptable case, which were all better than the worst case plus waiting two years scenario. The most important part of the deal was the quickness of the sale. The sale would close in roughly a month vs. the two years it took an identical comparable property.

How I could have improved?

As I venture more into real estate, I intend to make websites for each of my properties, but how do I improve upon these surprising successful results?

- Build the Site Sooner: I should have built the website much earlier in the process. This action would have given me far better SEO (search engine optimization) benefits from Google, which slowly allows unique websites to rise in rankings “over time”. By the time I wanted to sell, the website would have been #1, thus allowing me to lower my advertising budget and still get lots of clicks to the site. In this case, I didn’t get any SEO benefits since that site was online for only a month.

- Game the System: Custom websites don’t count against the all-important metric of “how long the house has been on sale” that buyers use to gauge their initial interest. New properties create excitement, because others feel they could get snatched away quickly; whereas, older listings beg the question of “what’s wrong?”

- Better pictures: We are a picture first society (e.g. Instagram vs. Twitter). Before I move into another house, I’m just going to have professional pictures done to make sure the lighting and staging are perfect. It’s easier to do this than it is to tell a renter to clean up, which turned out to be a major negative, per my broker comments. Warning: An untidy house will knock off % points from the sale price.

- Did I get lucky? I’m sure luck had something to do with my success, but too many things fell into place for luck to explain a winter sale of a difficult property in a raising interest rate environment with a terrible comparable. Maybe the next property will definitively show the value of this approach.

I hope this helps all those would-be real estate sellers. I certainly will do this process again. The investment of time and money was relatively small to the estimated 75k to 100k that I saved by using this approach, which roughly translates to a ~2400% return on my digital investment.

If any points were not clear, write a comment and I’ll be happy to explain further.

Good luck,

Dave

Dave,

First, hope all is well! It’s been a long time. Second, we are currently selling our home and appreciate your experience/advice. Do you think this type of marketing would translate directly to a traditional suburban home sale? I’m definitely going to look into some of your points.

Kevin

Great article.Much thanks again. Great. Kotlar